Stories of Growth

Alan Sampson, Solid Solutions: “Finding my own way”

As part of our Stories of Growth series, we interview the co-founder of a leading 3D design software business.

12 September 2023

In 2016, BGF invested £8 million into 3D design software business Solid Solutions, to help it grow by acquisition. BGF exited the investment in 2020 when private equity firm LDC took on a minority stake in the business.

In this interview, Solid Solutions co-founder Alan Sampson explains how BGF funding enabled the company to realise its growth plans.

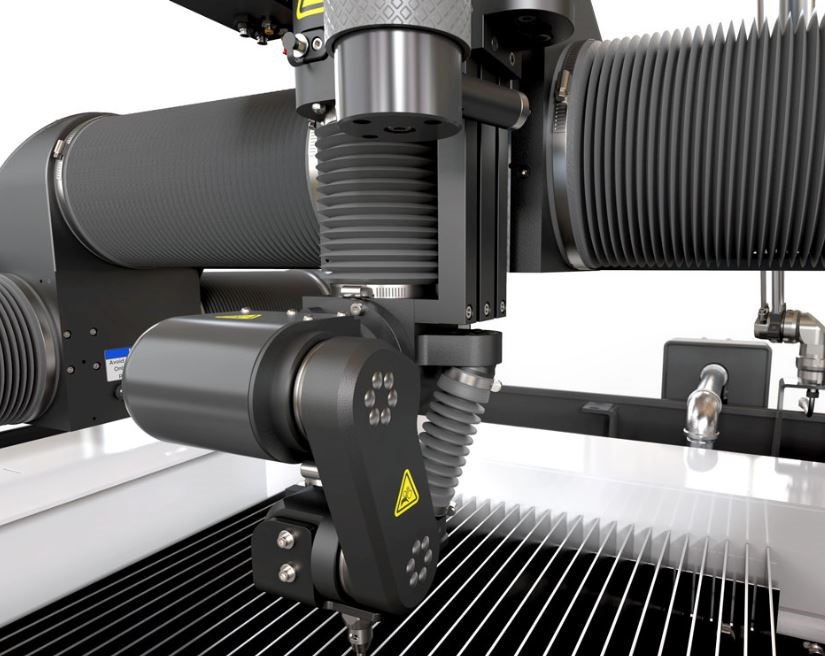

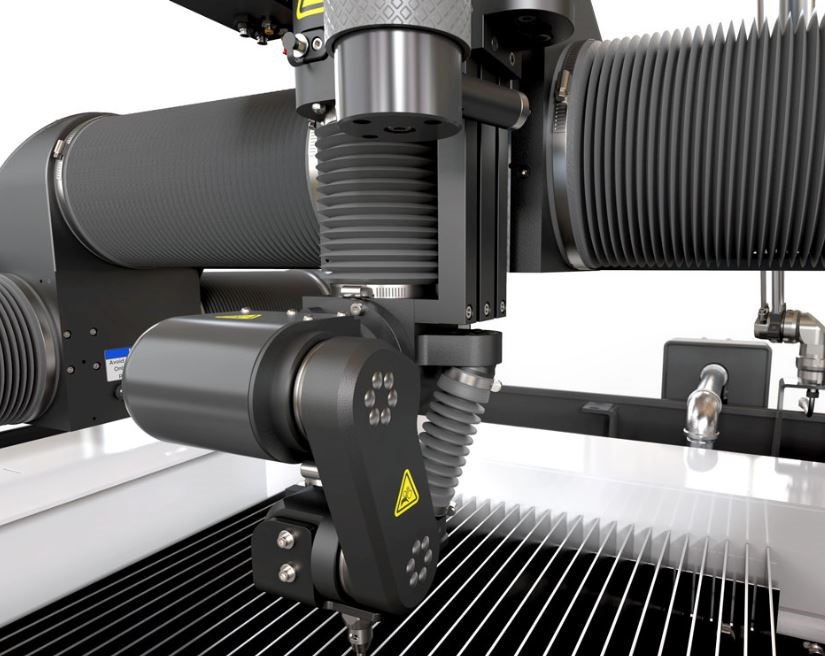

It was the end of ’98 that we started the business. My background was in engineering and design and then I got involved in computer-aided design (CAD) systems. I worked for some car manufacturers and saw that CAD tools, which had been used by a few in automotive and aerospace, were now available to design everyday products. It was a small market, but I could see it becoming big as these tools were more affordable and reliable than other systems.

My wife Kathy and I were in good jobs, so it took a lot of soul searching, but we decided at the end of ’98 to put our house on the line and set out on the journey. We had a young family as well, so it was pretty scary – we couldn’t be sure our savings wouldn’t disappear before we hit the upslope in terms of cashflow. But in the end, it took us only six months before we were doing well.

“People thought we were crazy”

For 15 years, we focused most of our energy on hiring good people. We love enthusiasm so that’s always near the top of the list of attributes we seek and it may even come ahead of how bright they are. Certainly, the idea of not working for others was appealing. When we left our jobs, we asked ourselves why – people thought it was crazy. Our lives were stable and secure, which ticked all the boxes. But we just weren’t enjoying routine.

I had no other option

We had always wanted to start a business. My wife and I had gone to franchise shows – we had looked at food, holidays. We just wanted to start something and grow it. I don’t come from a family of entrepreneurs. I just wanted to shape something. To build something. Home life wasn’t ideal. That’s why I left school early. I had to find my own way. I had no other option.

We started conversations with BGF in 2015. Initially, we got cold feet and walked away. Then, about a year later, there were some changes in taxation around entrepreneurs’ relief. BGF called out of the blue and asked if we would reconsider, given what was happening. We dusted everything off, had another look and took the leap.

At the same time, we were looking to buy one of our competitors. We ended up acquiring them the same month we did the BGF deal. It was an exciting time and a huge success. We were pleased with ourselves – how good we were at integrating the systems and people and cultures. That left us with a great appetite for more acquisitions. We like that route to growth – ‘buy and build’ lets you do things much faster.

There are always bumps in the road, but they have been small bumps. At odd periods there have been sleepless nights. But I like a challenge.

Making products better

We work with customers every day on their designs, often sharing the same screen. It’s like a collective intelligence that makes their products better. There’s a lot of pressure in product design on timescales. A few years ago, a customer was designing a lawnmower, and if it wasn’t ready for the Argos catalogue, they would have missed a year – nearly all sales of lawnmowers are in spring. They were behind schedule, but we helped them make the deadline, so they got that year’s worth of sales. That interaction and interdependency happens all the time. Our growth doesn’t happen without their growth.

I’m at home and surrounded by products designed by our customers. I like owning products that were designed with our software – like the Brompton bicycle. Let’s hope I don’t need a Stannah Stairlift any time soon though! We only sell what we believe in and what we see as a good product.

A successful BGF exit

In 2020, BGF exited – everyone did very well. We were slightly concerned that LDC, our new partner, wouldn’t be as light touch and friendly as BGF but they proved to be similar. The big thing for us in selecting both partners was that we wanted someone who would allow us to make decisions quickly. We didn’t want to spot an acquisition and have to wait weeks for sign off. We wanted to be able to pick up the phone and get the go-ahead.

Private equity doesn’t always get good press, but we found that BGF helped us and gave us confidence, and when you build a business, all your wealth is in the business. Now, we finally have some money to enjoy. We didn’t want to invest everything to take the next step. Having an equity partner is so valuable.

“BGF helped us and gave us confidence”

It’s hard when a business grows. You’re always questioning yourself. Luckily, I had enjoyed a blend of industry and academia from the point I left school at 16 through to post-grad and into my twenties. In the early part of my career, I did officer training in the Merchant Navy. Later, I was with Marconi on their graduate programme, so I got a broad industrial view. I worked with Warwick University and car companies.

Still, it’s hard to keep constantly adjusting to new challenges. Because we have lots of offices, getting engagement with staff is still key and it’s easy to miss stuff. You’re constantly reinventing the way you interact with staff. We have scored highly on Best Companies lists, though. It’s not always easy to get the feedback but you have to act on it.

You always have to look for opportunity. There are times you might give up on that but you mustn’t. Times and markets change, so stay positive and always look for opportunities.